SOFR Trade Idea

Fed Targets, Forward Pricing, and a Trade Opportunity

The Federal Reserve's dual mandate—targeting employment and inflation—has always been a key driver of market expectations. To assess how well the Fed might achieve these goals, we can track both historical data and forward-looking metrics:

Employment Metrics: Historical unemployment data provides a snapshot of where we stand, while leading indicators like hiring intentions and broader growth metrics offer insight into potential shifts in the labor market. Below we see relative to the unemployment level the pricing of the fwd curve is at an extreme

Inflation Dynamics: Observed inflation guides the Fed's current posture, but forward pricing in swaps markets provides a window into future expectations, highlighting potential policy adjustments.

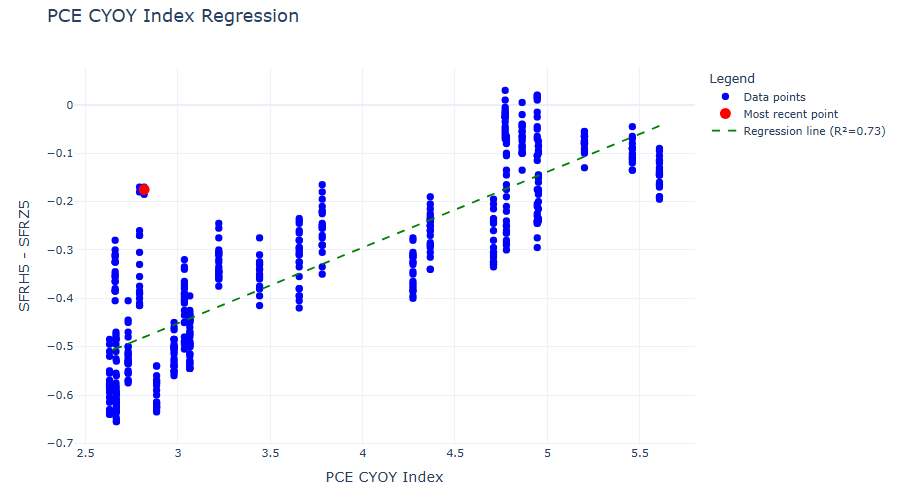

Below we can see that relative to inflation (PCE Core - the Feds favorite measure of inflation) is inconsistent with fwd pricing of the curve.

When these two pillars of Fed policy show disconnects in forward market pricing, opportunities arise.

Trade Idea: Exploiting Mispriced Rate Expectations

Trade: Short SFRH5 vs. Long SFRZ5

Keep reading with a 7-day free trial

Subscribe to Global Macro Method to keep reading this post and get 7 days of free access to the full post archives.